- Fed rate-hike expectations cool slightly

- Tech stocks see continued hit and VIX climbs to 3-1/4 month high

- Italian bond yield reaches new 4-1/2 year high as populists bash the EU

- Chinese markets show the expected plunge upon Monday’s holiday return

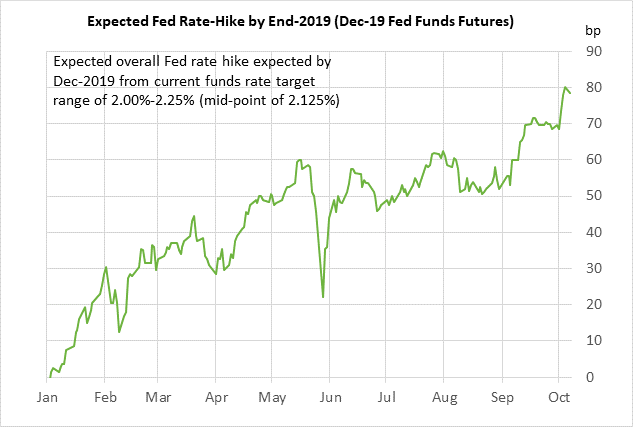

Fed rate-hike expectations cool slightly — The Dec 2019 federal funds futures contract on Monday fell slightly by -1.5 bp to a yield-equivalent of 2.91% from last Friday’s peak of 2.925%. That means that expectations for the Fed’s overall rate hike through the end of 2019 fell slightly to 78.5 bp from last Friday’s peak of 80 bp. Still, the market is discounting 3.1 rate hikes through the end of 2019, up from only two rate hikes as recently as August.

The sharp rise in rate-hike expectations seen over the past several weeks has been due to (1) strong U.S. economic data, (2) hawkish comments by Fed officials including Fed Chair Powell, and (3) rising inflation expectations. The 10-year breakeven inflation expectations rate last week rose by +2.7 bp to a new 4-1/2 month closing high of 2.17% due in part to last week’s new 4-year high in oil prices.

This is a busy week for Fedspeak with three Fed officials speaking today and four Fed speeches during the remainder of this week. In addition, the world’s G-20 central bank chiefs will gather with their finance minister counterparts on Thursday/Friday for their meeting in Bali, Indonesia.

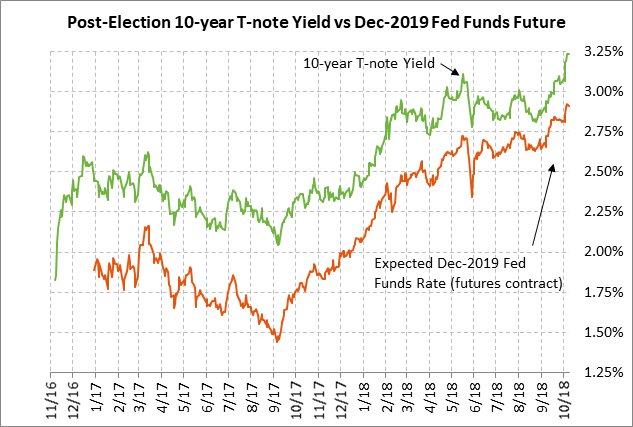

The U.S. cash Treasury market was closed on Monday for the Columbus Day holiday. The markets today will be waiting to see if T-note yields continue to climb even after last week’s +17 bp surge to a 7-1/3 year closing high of 3.23%. The Treasury market this week must absorb $230 billion worth of Treasury auctions. The Treasury will sell T-bills today (due to Monday’s holiday), $36 billion of 3-year T-notes and $23 billion of reopened 10-year T-notes on Wednesday, and $15 billion of reopened 30-year bonds on Thursday.

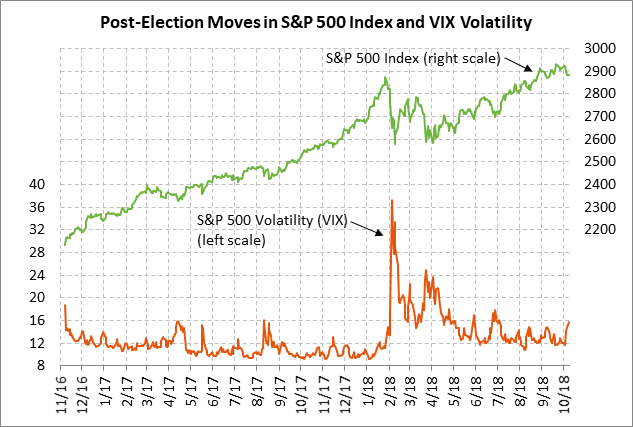

Tech stocks see continued hit and VIX climbs to 3-1/4 month high — Tech stocks on Monday continued to be hit hard as the broad stock market fell on the surge in bond yields. The Nymex Fang+ index on Monday fell by another -1.09%, bringing the 3-session (Thu-Mon) decline to a total of -5.93%. The Fang+ index on Monday fell to a new 5-1/4 month low and has corrected lower by a total of -15.3% from June’s record high.

Meanwhile, the Nasdaq 100 index fell by -3.73% since last Thursday and posted a new 1-1/4 month low on Monday. The S&P 500 index showed a more modest decline of -1.37% last Thursday/Friday and was then able to recover from early losses and close slightly higher by +0.05% on Monday.

The sharp sell-off in stocks seen in the past several sessions has caused an uptick in volatility, though not nearly as high as the 50% peak seen in February when the stock market plunged on President Trump’s tariff announcements. The VIX index on Monday spiked upward to a 3-1/4 month high of 18.38%, although the index then fell back to close the day up +0.87 at 15.69%. Prior to this week’s surge, the VIX averaged only about 13% during July-Sep.

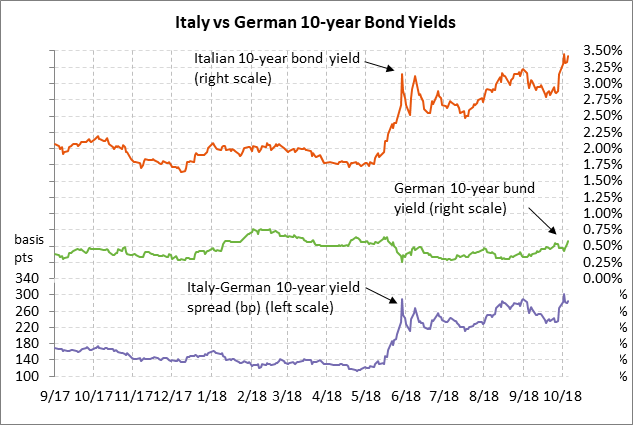

Italian bond yield reaches new 4-1/2 year high as populists bash the EU — The Italian 10-year bond yield on Monday rose by another +14 bp to 3.56%, posting a new 4-1/2 year high. The Italy-German 10-year yield spread on Monday closed +19 bp at 304 bp, taking out last week’s high and posting a new 5-1/4 year high.

Monday’s continued melt-down in the Italian bond market was prompted by fresh EU bashing as League leader Salvini said, “We are against the enemies of Europe — Juncker and Moscovici – shut away in the Brussels bunker. The politics of austerity of the last few years have increased Italian debt and impoverished Italy.” Even as Mr. Salvini launched his verbal assault on the EU’s top officials, Italy’s EU Affairs Minister Savona said he expects the ECB to help Italy in case of a financial crisis.

There is no sign that Italy is backing down on its plan for a deficit of 2.4% of GDP in 2019 even though the EU has already indicated that would be a significant deviation from the Italy’s expected fiscal path. Italy’s parliament today will begin debating the budget. Italy’s two houses of parliament must approve the draft budget and the budget must be submitted to the European Commission by this coming Monday (Oct 15). The Commission then has up to two weeks if it wishes to demand budget changes to conform to Eurozone’s fiscal rules. The markets will become even more concerned if the EU tries to force Italy’s populists to back down on the 2.4% budget deficit.

The markets already expect the rating agencies to knock down their credit ratings on Italy by a notch with their reviews due by the end of this month. That would leave Italy’s ratings only one notch above junk. A reduction into junk territory would be a disaster since that would prevent Italian government securities from being used in ECB refi operations and would also devastate Italian banks holding Italian government securities.

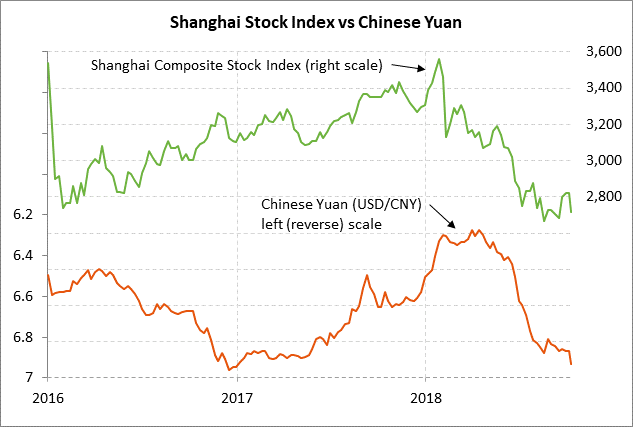

Chinese markets show the expected plunge upon Monday’s holiday return — The Shanghai Composite Index on Monday plunged by -3.72% and posted a new 3-week low high as Chinese investors returned from their week-long holiday. Meanwhile, the Chinese yuan fell by -0.90% to 6.9307 yuan/USD where it was just above August’s 1-3/4 year high of 6.9376 yuan/USD.

The Chinese central bank’s 1 point cut in the bank Required Reserve Requirement on Sunday wasn’t sufficient to provide much support to the Chinese stock market on Monday. Indeed, the PBOC’s looser monetary policy sparked a sharp -0.9% sell-off in the yuan, which in turned raised new fears about capital flight from Chinese stocks. Bloomberg reported that foreign investors on Monday dumped $1.3 billion of Chinese A-share stocks through Hong Kong exchange links, illustrating declining foreign confidence in Chinese stocks.