- Today’s auctions will test investor demand with Treasury yields near new highs

- U.S. PPI expected to remain below recent highs

- Italian bond yield falls back from 4-1/2 year high

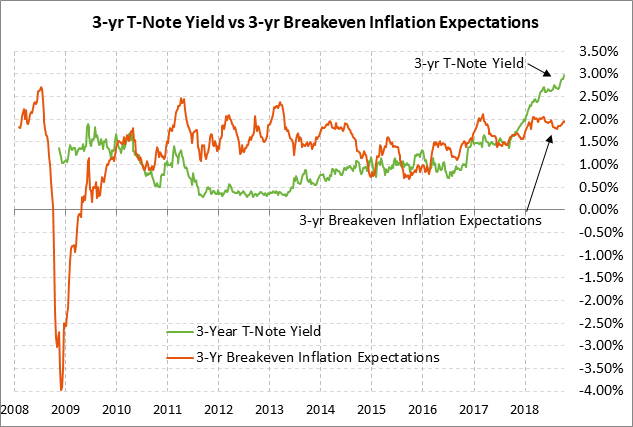

Today’s auctions will test investor demand with Treasury yields near new highs — The Treasury’s sale of 3-year and 10-year T-notes today and 30-year bonds tomorrow will provide a test about whether investors see value after last week’s surge in T-note yields, or whether a further rise in yields may be necessary for the Treasury to unload its securities. The benchmark 3-year T-note yield late yesterday was trading at 2.98% and the 10-year yield was trading at 3.20%.

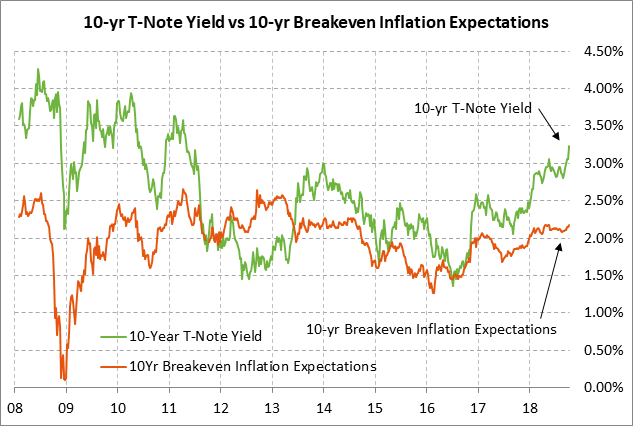

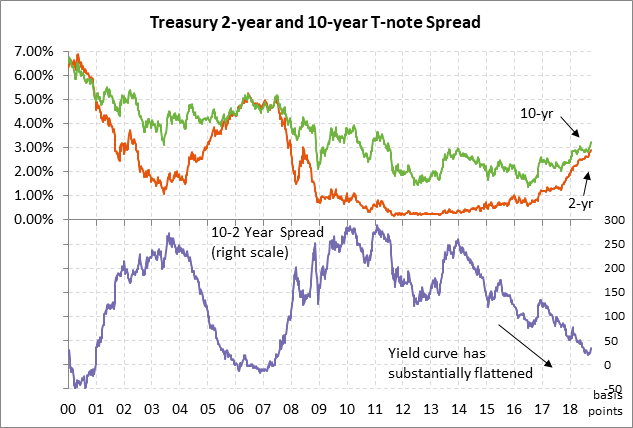

The 10-year T-note yield reached a new 7-1/2 year high of 3.26% yesterday but then fell back to close the day -3 bp at 3.20%. The yield is still up by +14 bp since last Tuesday on the combination of (1) increased expectations for Fed rate hikes and recent hawkish Fed comments, (2) strong U.S. economic data including the drop in the unemployment rate to a 49-year low of 3.7%, and (3) higher inflation expectations. The current 10-year breakeven inflation rate of 2.17% has risen by 4 bp in the past week due in part to last week’s surge in crude oil prices to a new 4-year high.

The $36 billion size of today’s 3-year T-note auction is up by $1 billion from last month’s $35 billion size and is up by +$12 billion (+50%) from the $24 billion size that prevailed during 2015/17. The shorter-end of the yield curve has taken the brunt of the Treasury’s hike in its auction sizes to cover the higher budget deficit caused by the Jan 1 tax cuts and by increased government spending. Today’s $23 billion T-note auction is up by $1 billion from the last reopenings in June-July and is up by $3 billion from the $20 billion reopening size seen during 2016/17.

The 12-auction averages for the 3-year are: 2.84 bid cover ratio, $78 million in non-competitive bids, 3.8 bp tail to the median yield, 26.4 bp tail to the low yield, and 56% taken at the high yield. The 12-auction averages for the 10-year are: 2.52 bid cover ratio, $19 million in non-competitive bids, 4.1 bp tail to the median yield, 15.7 bp tail to the low yield, and 19% taken at the high yield.

The 3-year is unpopular among foreign investors and central banks with indirect bidders taking an average of only 49.6% of the last twelve 3-year auctions, well below the median of 63.1% for all recent Treasury coupon auctions. By contrast, the 10-year is a little above average in popularity with indirect bidders taking an average of 63.9% of the last twelve 10-year T-note auctions.

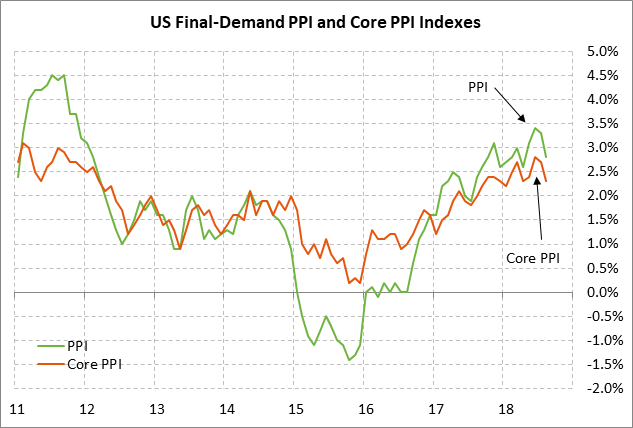

U.S. PPI expected to remain below recent highs — The market consensus is for today’s Sep final-demand PPI to ease slightly to +2.7% y/y from Aug’s +2.8% but for the core PPI to rise to +2.5% y/y from Aug’s +2.3%. The Aug PPI figures were well below June’s 7-year high of +3.4% y/y headline and +2.8% core.

The good news is that all the U.S. inflation statistics in August softened, or at least remained unchanged, from the peaks seen in June/July. The headline Aug CPI fell to +2.7% from July’s 6-1/2 year high of +2.9% and the Aug core CPI fell to +2.2% from July’s 10-year high of +2.4%.

Meanwhile, the headline Aug PCE deflator in August eased slightly to +2.2% from July’s 5-1/2 year high of +2.3% and the Aug core PCE deflator was unchanged from the 4-1/2 year high of +2.0% seen in the previous several months. On a 3-month annualized basis, however, the headline PCE deflator in August fell to a 13-month low of +1.4% and the core deflator fell to a 15-month low of +1.3%.

The Treasury market would be particularly pleased if today’s core PPI and tomorrow’s core CPI reports showed continued moderation. That would suggest that the T-note market might be overdoing its inflation concerns. The 10-year breakeven inflation expectations rate late last week rose to a 4-1/2 month high of 2.18% but then eased slightly to 2.17% on Tuesday.

Considering the moderation of the August inflation statistics, the main reason behind the recent rise in inflation expectations was last week’s new 4-year high in oil prices. In addition, the market remains worried about wage inflation with last Friday’s Sep average hourly earnings report of +2.8% y/y, which was just 0.1 point below August’s 9-year high of +2.9%. As long as the actual inflation statistics remain contained, however, the market does not have much reason to become overly concerned about the inflation outlook.

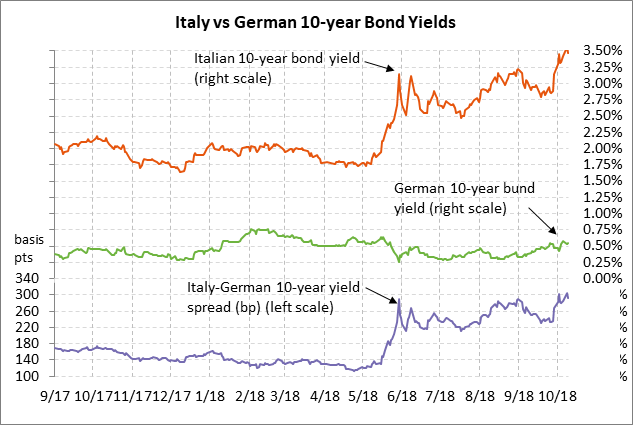

Italian bond yield falls back from 4-1/2 year high — The Italian 10-year bond yield on Tuesday fell by -9 bp to 3.47% from Monday’s 4-1/2 year high of 3.56%. The Italy-German 10-year yield spread on Tuesday fell by -11 bp to 293 bp from Monday’s 5-1/4 year high of 304 bp.

The Italian bond yield on Tuesday fell mildly after Italian Finance Minister Tria appealed for calm and Italy’s populist leaders refrained from launching any new broadsides against EU officials. League leader Salvini on Monday called top EU officials “enemies of Europe.” Still, there is no sign that the populist government plans to back down from their 2019 draft budget deficit of 2.4% of GDP even if EU officials demand changes. In addition, there are rumors in the markets that the government is willing to see a Italian-German bond spread as high as 400 bp before they begin to panic, which is about 50 bp higher than current levels.

Italy’s parliament is debating the budget this week and must approve the budget before this Monday’s deadline for submission to the European Commission. The Commission then has up to two weeks if it wishes to demand budget changes to conform to Eurozone’s fiscal rules.